Leverage Technology with a Virtual Assistant

Have you ever heard the true story about the farmer and his donkey?

Hearing a noise coming from his well, the farmer looked in and saw one of his donkeys at the bottom. He couldn’t find a way to get the animal out and since it was quite old, he figured it wouldn’t be worth the time and effort to extricate it.

Instead, he asked his neighbors to help him bury the donkey alive. As everyone began dumping dirt into the well, the donkey, terrified, began moaning, kicking and stomping about. The neighbors kept shoveling dirt into the hole and eventually, the donkey fell silent.

Later, when the farmer looked into the well, he was amazed at what he saw! As more and more dirt filled the well, the donkey packed it down with his feet, causing him to rise up higher. Soon the donkey was able to walk right out of the well!

This story reminds me of the challenges Virtual Assistants (VA) who work with Financial Advisors have had to face in the last several years. Technology continues to change at a fast pace and if a Virtual Assistant wants to stay competitive, they have to continually be looking ahead to see what is coming and prepare for it so that they can help their clients be successful, otherwise, they risk being buried alive!

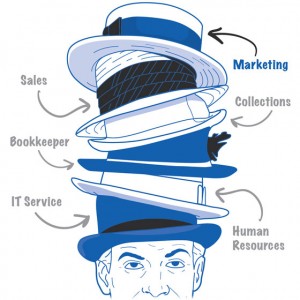

As a pioneer in the Virtual Assistant industry, I’ve had firsthand knowledge of how technology changes the way we work with clients. Some of the biggest changes have come with the introduction of the “cloud”. Allow me to give you a few examples of those changes:

Documents in the Cloud:

Just a few short years ago our office went through some dramatic changes as it relates to how advisors sent their quarterly portfolio reports and other documents to their clients. In years past, every quarter our staff would be ‘all hands on deck’ as we printed, assembled, folded, stuffed, sealed, weight and postaged several thousand portfolio reports. It was big business for us. Then the cloud came along and started to change all of that. Today, we only process a few hundred reports per quarter the old way. Time is now spent uploading the reports to client portals or document vaults. Clients are happier because they receive their reports quicker. Since they are already digitalized, they don’t have to scan them for their records. The advisors are also happy because not only are they saving money, they can market this as a ‘value-added” service that makes them look good. The good news for a VA is that allows them to focus on other ways to help their clients be successful and grow.

Marketing in the Cloud:

In the “old” days our office would spend a lot of time helping advisors with the leads that came into the office. Upon receiving the first phone call or email lead, we would add the prospect to their database then assemble and mail a marketing packet. The packets usually consisted of a glossy high quality pocket folder filled with colored copies of the firm’s history, advisor bio, a photograph, copies of news articles, the latest newsletter and more. We would then place them in a drip program where we would send high-quality post cards, newsletters and other documents that were sent out about every six to seven weeks with the intent of getting the prospect to know, like and trust them until they were ready to become a client. Marketing like this was not cheap and was limited to only to the leads sent to them by various vendors.

Today advisors market “in the cloud” where they can reach more people and for the amount of prospect they reach, it can cost less. Websites have replaced the costly marketing folders and although websites aren’t cheap, they can be updated at a moment’s notice allowing the advisor to keep all their marketing material current. If done correctly, setting up a drip marketing program in the cloud using tools such as a blog, e-newsletters and social media, the advisor can now get the word out just like larger firms in the industry.

If you’re the type of advisor that markets through seminars to attract new clients, Webinars are now the way to go. In the past when an advisor wanted to set up a seminar; invitations had to be designed, printed and then mailed out to a purchased mailing list, location selected and paid for, track RSVP’s, print and assemble name tags, handouts, order refreshments and more. Today, instead of mailing out invitations, announcements can be sent out via email, blogs, social media, from your website and other outlets. You can even video tape your invitation for a more personal touch. Instead of printing out handouts, documents can be uploaded or emailed in .PDF format. Webinars can also be taped and later re-purposed so you don’t have to do it all over again. Many advisors have the webinar uploaded to their website where prospects and clients can download and watch it after entering their contact information. Once you receive their contact information, they can be added to your drip marketing program. The tech savvy VA can set all of this up for you so you don’t have to learn any of it yourself.

Meetings with Clients and Prospects in the Cloud:

With client’s leading busier lives than ever, getting them into the office for their quarterly or yearly appointments used to be difficult. Not anymore. Programs such as GoToMeetings and Mikogo allow the advisor to hold virtual meetings in the cloud. Clients can meet with their advisor over the breakfast table, during their lunch hour or in the evening after the kids are in bed. In turn, the advisor doesn’t need to meet in his office. Virtual meetings frees up the advisors time so that they can take on more clients, meet with more prospects and add more freedom to their schedule.

By using Screen Share software the advisor is able to review documents, articles and important information from his computer screen just as if clients were sitting in front of him at the office. Meetings can also be recorded and later emailed or uploaded to the client’s portal. Client’s love this and has become another ‘value added” service advisors can market to their clients.

The List Goes On

The examples above are just scratching the surface, I haven’t even mentioned how e-signatures have changed the way we handle client services and account applications but I hope you get the drift.

If you want to leverage technology and need help doing it, partnering with an established, forward thinking, tech savvy Virtual Assistant (VA) is one way that many advisors are keeping up.

A Virtual Assistant is more than someone that helps you get things done in your office. They are also a business owner who’s job is to keep up with the newest in technology and share that with their clients. Partnering with one will keep you from getting buried alive, instead, they can help you walk on firm ground.

Note: This article was first published online at: www.TheDigitalFA.com

©2014 Sherry Carnahan

I agree! VA’s are an excellent way to keep up-to-date on all the new and exciting technologies available to make business more fluid and effective for the business owner, as well as, accessible for clients. Especially new and younger clients who are looking to work with those who utilize technology in a manner that makes their busy and ever changing lifestyles more manageable.