5 Signs That You Need A Financial Virtual Assistant

What are three tasks you could assign to an assistant

this week if you had one?

And, what would YOU do with the extra time you’d gain?

If just thinking of having extra time in your schedule brings you a sense of relief, that might be your first sign!

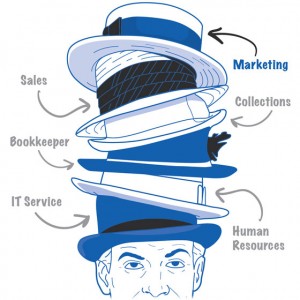

Over the years, we have spoken to so many financial advisors who try to do it all themselves, primarily because they just don’t have time to even think about what they need or who they should hire. After all, it takes a lot of time, money and energy to look for, train and then maintain an employee. If you’re lucky, they will stay and become a long-term employee, but the fact is, many either don’t work out or they leave for a better opportunity a short while later. Many feel they have no other choice but to keep doing everything themselves.

But the truth is, not getting help can cost you. In fact, trying to do it all can hurt your business growth and throw your personal life off balance. So, what’s the alternative? Hiring a Financial Virtual Assistant! One that is already trained in your industry, knows the lingo and the ins and outs of getting things done within the industry. While the hourly rate you pay for an assistant is higher, in the grand scheme of things it is not. That’s because a Financial Virtual Assistant (FVA) is in business for themselves, so they are motivated to work. They train their own employees, buy and maintain their own equipment, pay their own taxes and because you’re not paying them to stand at the water cooler or read a magazine when work is slow, your billable hours are drastically reduced.

By hiring a financial virtual assistant who is already trained in your industry, they can help you manage your business more efficiently, freeing you to focus on the big picture and doing what you do best.

To help you determine if it’s time to get help, here are :

FIVE Signs That You Need to A Financial Virtual Assistant

1. You dread filling out forms or hanging on the phone with custodians all day.

Most of us have tasks we dread doing. Some people can’t stand filling out account applications, tracking transfers or setting up RMD’s. The great news is, a Financial Virtual Assistants actually LIKES doing what you despise. An experienced FVA will know the ins and outs and tricks of the trade to get things done and completed so both your clients and you are happy with the outcome. So why not bring them on to handle these tasks with passion and dedication? It’s a win-win!

2. You forget to perform tasks, like following up on an account opening or checking on a transfer, making sure a client’s beneficiaries were updated. The list goes on.

Performing all these tasks are an important part of your business; if you let them fall through the cracks, other things will too and before you know it, things are snowballing on you. Imagine how life would be if you had someone taking care of all these tasks for you.

3. You’re missing annual and semi-annual appointments with your clients.

Meeting with your clients is a must. Yet, the whole process of scheduling and preparing for client meetings can be daunting, especially when you already don’t have time on your schedule. Not to mention handling post-meeting tasks. By passing the process off to an experienced Financial Virtual Assistant, you can start meeting with clients again without the hassle of preparing for it.

4. You stop bringing in new clients because you don’t have time or know how to market your business.

For most Financial Advisors that we talk to, marketing is the last thing on their to-do list even though they know they need to do it. Many don’t know what to do and when they do, it’s much too much of a time-consuming task to complete. That’s where a Financial/Marketing Virtual Assistant can help. Since they know the Financial Industry, they can help you create a plan and implement it so that you no longer have to worry if prospects will keep coming in.

5. You don’t have time to see family or friends.

When you find yourself missing out on family dinners or your child’s sports events in favor of work, then it might be time to re-prioritize. Hiring a Financial Virtual Assistant—even one who works just a few hours a week—frees you up to focus on what matters, like spending time with loved ones and experiencing those once-in-a-lifetime moments first-hand.

So, I ask you:

What are 3 tasks you could assign to an assistant this week if you had one? And, what would YOU do with the extra time you’d gain?

If you still need help thinking of what you could give to your Financial Virtual Assistant, check out our complementary Advisors Job Function List

When you’re done looking it over, I invite you to contact us to set up a conference call to discuss how we can help!

Copyright 2017 – 2019 Sherry Carnahan